[ad_1]

Well, another year is nearly in the books, which means it’s time to look ahead to what the next 365 days have to offer.

While 2022 felt like it couldn’t get any worse, 2023 surprised us all by being an even rougher year.

Thanks to the highest mortgage rates in nearly a century, loan origination volume ground to a halt, as did home sales.

The only real bright spot was new home sales, though builders had to make some big concessions to unload their inventory.

So what does 2024 have in store? Well, the good news might just be that the worst is finally behind us.

1. Mortgage rates will drop below 6% (and maybe even 5%)

First things first, mortgage rates. While I (and many others) expected mortgage rates to fall in 2023, they defied expectations.

Rates began the year 2023 on a downward slope, but quickly reversed course and surpassed 7% by spring. Then things got even worse as rates climbed beyond 8% in October.

However, inflation has since cooled and economic reports continue to signal that the worst of it could be over.

The Fed has also gotten on board, with their latest dot plot signaling rate cuts for 2024. After raising rates 11 times in less than two years, there could be three or more cuts next year.

While the Fed doesn’t control mortgage rates, their monetary policy tends to correlate. So if they’re cutting rates due to a cooling economy, mortgage rates should also fall.

We’ve already seen mortgage rates ease in anticipation, and they’re expected to go even lower throughout 2024.

This should be helped on by normalizing mortgage rate spreads, which remain about 100 basis points above typical levels.

In my 2024 mortgage rate predictions post, I made the call for a 30-year fixed below 6% by next December.

The way things are going, it could come sooner. And rates could go even lower, potentially dropping into the high-4% range if paying discount points.

2. Homeowners will refinance their mortgages again

I expect 2023 to go down as one of the worst years for mortgage refinances in history.

Interest rates increased from around 3% in early 2022 to over 7% in about 10 months.

Then continued their ascent higher in 2023, meaning very few homeowners benefited from a refinance.

However, two things are working in homeowners’ favor as we head into 2024.

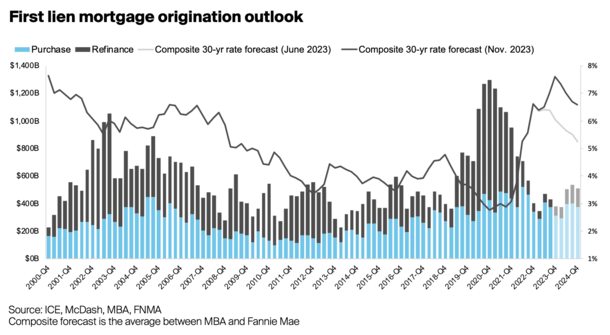

There were about $1.3 trillion in home purchase loan originations during 2023, despite it being a slow year.

And rates have since come down quite a bit from what could be their cycle highs.

If we consider all those high-rate mortgages that funded over the past year and change, we might have a new pool of refi-eligible borrowers, as seen in the chart above from ICE.

It’s also easier to be in the money when refinancing a high-rate mortgage since the interest savings are larger.

So I expect more rate and term refinances in 2024 as homeowners take advantage of recent mortgage rate improvements.

In addition, we might see homeowners tap equity via a cash out refinance if rates keep coming down and get closer to their existing rate.

Refi volume is forecast to nearly double, from around $250 billion this year to $450 billion in 2024.

3. Mortgage rate lock-in will be less of a thing

With less of a gulf between existing mortgage rate and potential new, more homeowners may opt to list their homes for sale.

One of the big stories of 2023 was the mortgage rate lock-in effect, whereby homeowners were deterred from selling because they’d lose their low mortgage rate in the process.

But if the 30-year fixed gets back to the low-5% range, or even the high-4s, more homeowners will be OK with moving.

This is one part affordability, and another part caring less about their low-rate mortgage.

Very few are willing to give up a 3% mortgage rate when rates are 8%+, but the story will change quickly if and when rates start with a 5.

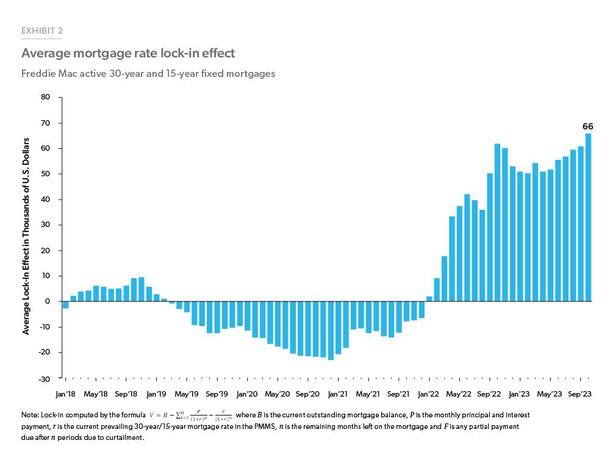

The chart above from Freddie Mac quantifies the value of a low-rate mortgage.

Aside from allowing people to free themselves of their so-called golden handcuffs, it will also increase existing home sales.

The big question is will it increase available supply, or simply result in more transactions as sellers become buyers?

4. For-sale inventory will remain limited

While I do expect more sellers in 2024, at least when compared to 2023, it might not move the needle on housing supply.

The big story for years now has been a lack of available for-sale inventory. Everyone expected home prices to crash when mortgage rates more than doubled.

Instead, home prices went up because of simple supply and demand. There just aren’t enough homes for sale in most markets nationwide.

As such, prices have defied logic despite worsening affordability. Demand is low but so is supply. And I don’t expect things to get much better.

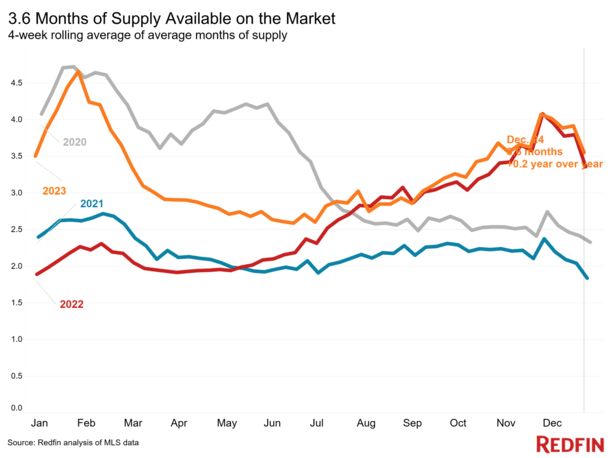

At last glance, months of supply was around 3.5 months, per Redfin, below the 4-5 months considered balanced.

Sure, lower rates and sky-high prices can get stubborn home sellers off the sidelines. But guess who else is waiting? Buyers. Lots of them who may have been priced out due to 8% mortgage rates.

In the end, it might be a zero-sum game, at least in terms of inventory as more sellers are met with more buyers.

Of course, it will be good for real estate agents, loan officers, and mortgage brokers thanks to a greater number of transactions.

5. Home prices may go down despite lower rates

Lately, there’s been a lot more optimism in the real estate market thanks to easing mortgage rates.

In fact, some folks think the boom days are going to return in 2024 if the 30-year fixed continues to trend lower.

While I’ve constantly pointed out that mortgage rates and home prices don’t share an inverse relationship, it doesn’t stop people from believing it.

Sure, the logic of falling rates and rising prices sounds correct, but you’ve got to look at why rates are being cut.

If the economy is headed toward a recession, even a mild one, home prices could also come down, despite lower interest rates.

Similar to how rates and prices rose in tandem, the opposite scenario is just as possible.

However, because rates are only expected to come off their recent highs, and only a small recession is projected, I believe home prices will continue to increase in 2024.

Interestingly, they may not rise as much in 2024 as they did in 2023, and could even fall in many markets nationwide.

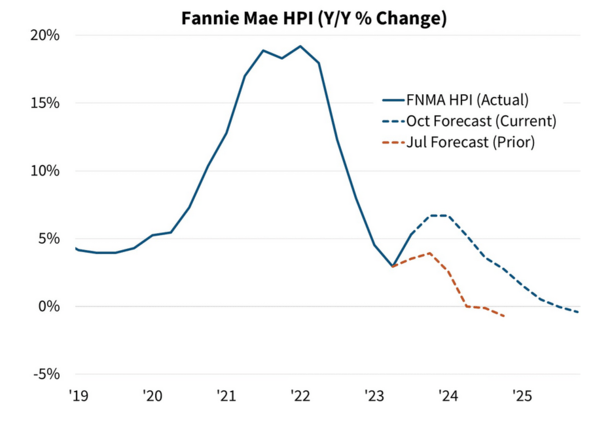

Both Redfin and Zillow expect home prices to fall next year, by 0.2% and 1%, respectively. Fannie Mae is also a bit bearish, as seen in the chart above.

I’m a bit more bullish and believe home prices will climb 3-5% nationally. But this still feels like a modest gain given recent appreciation and the lower rates forecast.

6. The bidding wars won’t be back in 2024

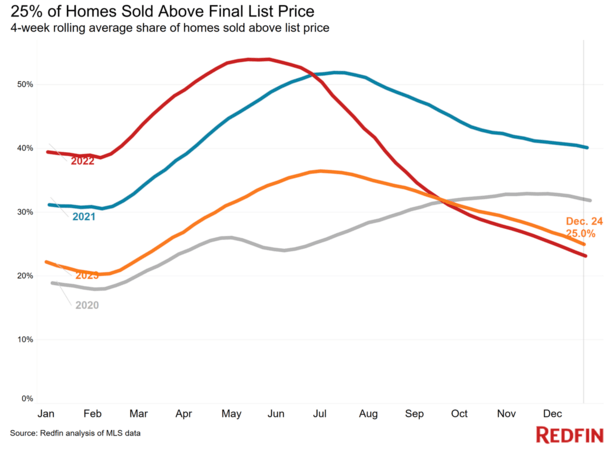

Along the same lines as home prices stumbling in 2024, I don’t expect bidding wars to make a grand return either.

The narrative that lower mortgage rates are going to set off a feeding frenzy seems overly optimistic.

And even flat out wrong. Remember, affordability is historically terrible thanks to elevated mortgage rates and high home prices.

Just because rates ease to the 6s or 5s doesn’t mean it’s a seller’s market again. If anything, it might just be a more balanced market that allows for more transactions.

A lack of quality inventory will continue to plague the market and buyers will still be discerning about what they make offers on.

So the idea of getting in now before it’s too late will be misguided as it typically is. If you’re a prospective buyer, remain steadfast and don’t rush in for fear of missing out.

You might even be able to get a deal if you’re patient, including both a lower interest rate and sales price in 2024.

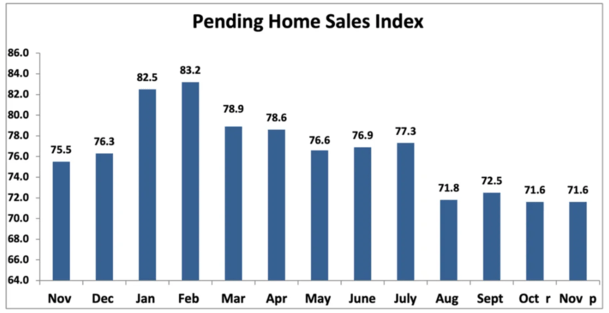

7. Home sales will increase slightly but remain depressed

Similar to mortgage rates peaking in 2023, I believe home sales may have bottomed as well.

NAR reported that November’s pending home sales were flat from last month and down 5.2% from a year ago. But things could begin to turn around in the New Year.

This means we should see home sales tick up in 2024, though not by much thanks to continued inventory constraints.

Remember, mortgage rates will remain at more than double their 2022 lows, despite some improvements from recent levels.

And while home builders have ramped up construction, there are still few homes available in most markets nationwide.

Most forecasts expect existing home sales to barely budge year-over-year, from maybe just below 4 million to just above.

Meanwhile, newly-built home sales may be relatively flat as well, perhaps rising from the high 600,000s to over 700,000 in 2024.

This will hinge on the direction of mortgage rates. The lower they go, the more sales we’ll likely see.

So things could turn out rosier than expected, though still quite low historically until the inventory picture changes.

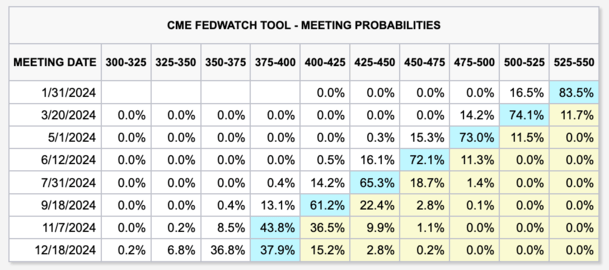

8. Home equity lines of credit (HELOCs) will get more popular

The Fed doesn’t raise or lower mortgage rates, but its own rate cuts directly impact rates on home equity lines of credit (HELOCs).

With several rate cuts expected between now and the end of 2024, HELOCs are going to become more and more attractive.

In fact, the latest probabilities from the CME have the Fed cutting rates by 1.5 percentage points by December.

So someone holding a HELOC today will see their rate fall by the same amount, as the prime rate moves in lockstep with the fed funds rate.

For example, a HELOC set at 8% will drop to 6.5% if all pans out as expected.

And because most homeowners still hold 30-year fixed mortgages with rates of 4% or less, they’ll opt for a second mortgage like a HELOC or home equity loan.

If the trend continues into 2025, these HELOCs will be a cheap source of funds to pay for home improvements, college tuition, or even a subsequent home purchase.

All while retaining the ultra-low rate on the first mortgage.

9. More buyers and sellers will negotiate real estate agent commissions

You’ve heard about the many real estate agent commission lawsuits. And changes are already on the way as those cases move along.

While both agents will still get paid to represent buyer and seller, there should be greater transparency in how they’re compensated.

And we may see some different methods of remitting payment. For example, a home seller paying the buyer’s agent directly, not on the listing agent’s behalf.

Of course, this could just result in different paperwork and no real change for the buyer or seller.

However, agents will likely be more transparent about the ability to negotiate, and this could be the key to saving some money.

Instead of being told the commission is 2.5% or 3%, they may tell you that’s their rate, but it’s negotiable.

This could result in home buyers and sellers paying less and/or receiving credits for closing costs.

It’s a step in the right direction as many consumers weren’t even aware these fees could be haggled over.

In the end, it should get cheaper to transact but you’ll still need to be assertive and make your case to receive a discount.

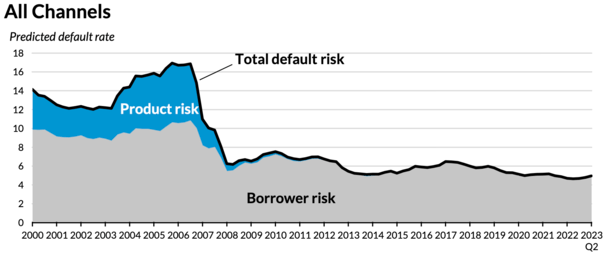

10. The housing market won’t crash

Finally, as I’ve predicted in past years, the housing market won’t crash in 2024.

While we are continuing to experience an affordability crisis of epic proportions, the speculative mania isn’t as pervasive as it was in the early 2000s.

And we can continue to thank the Ability-to-Repay/Qualified Mortgage Rule (ATR/QM) for that, as the screenshot from the Urban Institute illustrates.

After the early 2000s mortgage crisis, many types of exotic mortgages were banned, including interest-only home loans, neg-am loans, and even loans with mortgage terms over 30 years.

At the same time, lenders have to ensure a borrower has the ability to repay the loan, meaning no doc loans and stated income are mostly out as well.

While there are non-QM loans that live outside these rules, they represent a small share of total volume. And the minimum down payments are often 20% or more to ensure borrowers have skin in the game.

Interestingly, it is FHA loans and VA loans that are experiencing the biggest uptick in delinquencies, though they remain low overall.

Even if we see an increase in short sales or foreclosures, we’ve got a severe lack of inventory due to demographics and underbuilding for over a decade.

This explains why home prices are unaffordable today, and also why they’ve remained resilient.

A scenario likelier than a crash would be stagnant home price growth for a number of years, with inflation-adjusted prices potentially going negative at times.

But major declines seem unlikely for most metros nationwide. In the meantime, a combination of wage growth and moderating mortgage rates could make homes affordable again.

[ad_2]