[ad_1]

A new survey from U.S. News & World Report found that nearly half of homeowners with adjustable-rate mortgages regret the decision.

This is based on a nationwide survey of more than 1,200 respondents that took place between December 14th and 20th, 2022, via a company called PureSpectrum.

Only respondents with an adjustable-rate mortgage (ARM) were included in the study.

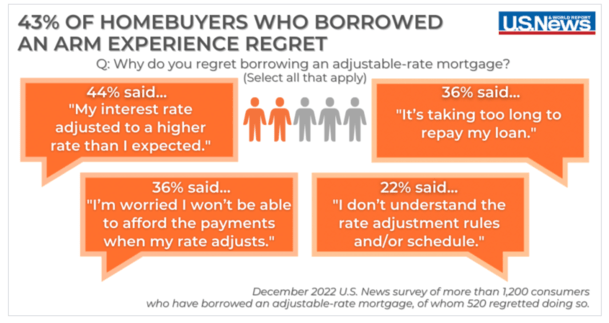

Perhaps the biggest takeaway was that 43% of the survey respondents regret choosing an ARM.

As for why, the most common response “was that their interest rate adjusted to a higher rate than expected.”

Homeowners Took Out Adjustable-Rate Mortgages Because They Wanted a Lower Payment

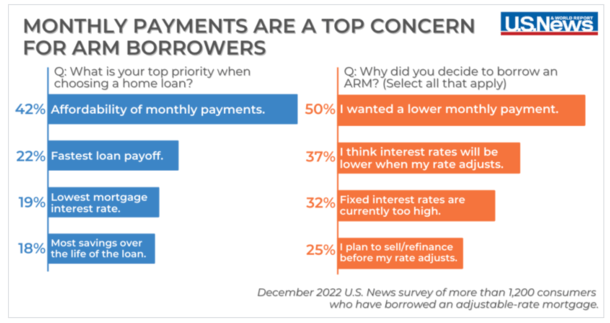

The survey also asked these homeowners why they opted for an adjustable-rate mortgage versus a more popular option, such as the 30-year fixed mortgage.

As expected, the top response was to obtain “a lower monthly payment.” This is basically the sole reason anyone would consider an ARM.

If it doesn’t save you money via a lower interest rate, there’s essentially no point in choosing one over the safety and stability of a fixed-rate product.

Interestingly, another 37% of respondents said they believe interest rates will be lower once their rate adjusts.

That’s a timely take because mortgage rates have doubled over the past year, and there’s a decent expectation that they fall back down to earth this year.

In fact, my 2023 mortgage rate predictions post has the 30-year fixed falling to the low-5% range by the second half of the year.

So they folks could be right to go with an ARM for the short term and look out for a refinance opportunity in the near future.

The big question is whether today’s ARMs are providing enough of a discount to take that chance.

At the moment, spreads between popular ARM products like the 5/1 ARM and 30-year fixed aren’t all that wide.

This means an ARM won’t save you a whole lot. In other times, the difference in rate can be more than 1%, which obviously could lead to some big savings for the first 60 months.

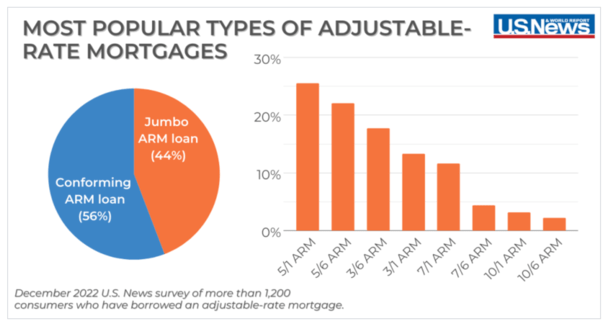

The 5/1 ARM Is the Most Popular Type of Adjustable-Rate Mortgage

Speaking of the 5/1 ARM, it happens to be the most popular type of adjustable-rate mortgage, followed by the similar 5/6 ARM.

The difference between the two products is that the former adjusts once annually after the first five years, while the latter adjusts every six months once it becomes adjustable.

The next most popular is the 3/6 ARM, which only provides a fixed-rate period for the first three years, or 36 months.

It was followed by the 3/1 ARM, then the 7/1 ARM and 7/6 ARM, and eventually the 10/1 ARM and its cousin the 10/6 ARM.

The discounts tend to wane as the fixed-rate portion of an ARM increases. After all, if lenders provide a fixed-rate period of seven to 10 years, you can’t expect a sizable difference in rate versus the 30-year fixed.

A Lot of Homeowners Don’t Seem to Understand How ARMs Work

While ARMs are somewhat popular (7.3% share per the MBA), it’s clear a lot of homeowners don’t actually understand what they’re getting into.

This could explain why so many of them regret the decision to take one out in the first place.

The study found that 22% indicated that they didn’t “understand the rate adjustment rules and/or schedule.”

I get that ARMs can be somewhat complicated, but you shouldn’t pick one unless you really have a firm grasp on the product.

Along those same lines, 36% regretted the decision because they felt it was taking too long to repay the loan.

This also reveals a misunderstanding of ARMs because if anything, they’d be paying down the home loan faster than a higher-rate fixed-rate product.

An ARM amortizes the same as a 30-year fixed during the fixed-rate period, and as noted, should pay down faster via the lower interest rate.

Are You Sure You Can Afford the Thing?

What’s perhaps scarier is 36% said they were worried about being able to afford the thing once payments adjusted higher.

And 32% said they outright wouldn’t be able to afford higher monthly payments if/when the thing became adjustable.

The silver lining is that 55% said they planned to sell their property or refinance their mortgage before the adjustment period.

That’s basically how ARMs should operate – as a temporary solution if you know you won’t keep the loan/property for a long period of time.

Otherwise you’re taking a chance on your mortgage rate adjusting significantly higher in the future.

To that end, 58% of respondents had reservations before applying for an ARM, and 47% knew they were riskier than fixed-rate mortgages.

The good news is 72% of ARM borrowers shopped with multiple lenders to compare mortgage rates.

That’s especially important as ARM rates can vary significantly (more so than fixed mortgages) between companies.

(photo: Gordon Joly)

[ad_2]