[ad_1]

Mortgage Q&A: “Mortgage rates vs. home prices.”

Today, we’ll look at the impact of home prices and mortgage rates on your decision to buy a property, along with the relationship they share.

Obviously, both are very important not only in terms of whether you should buy (from an investment standpoint), but also with regard to how much house you can afford.

The general logic is that mortgage rates and home prices have an inverse relationship, in that if one goes up, the other goes down. And vice versa.

But is this actually true? Or are there situations where both can rise together, making real estate even more expensive than it already is?

Mortgage Rates Are No Longer on Sale

- What’s more important (beneficial) to a prospective home buyer?

- A super low mortgage interest rate they can lock in for 30 years…

- Or a cheaper home purchase price at the outset?

- Let’s do the math and find out!

At the moment, mortgage rates are more than twice as high as they were a year ago. The popular 30-year fixed-rate mortgage averaging 6.50% last week, according to the latest data from Freddie Mac.

This has stopped the housing market in its tracks, and there are fears they could rise even higher over the next year and beyond.

Meanwhile, home prices remain close to all-time highs on a nominal basis, but perhaps not in real terms, though most folks feel they’re quite high, and perhaps even unsustainable.

This is made clear without the use of home price indices, fancy calculators, or algorithms…just take a look at some for sale listings and you’ll think home sellers are nuts for asking so much.

Problem is there just aren’t that many homes available, so even a list price that exceeds its expected value isn’t unheard of.

Properties are still going above their Zestimate and/or Redfin Estimate and still getting bites from buyers.

Home Prices Might Be Inflated

- Some economists think home prices are just too high these days

- Which could be a symptom of mortgage rates being so low for so long

- Coupled with a severe lack of housing inventory that has been an issue for years

- But sometimes the relationship isn’t as obvious as it looks and it might not play out how you think it will

Since home prices bottomed around 2012/2013, they’ve surged to new all-time highs, both nominally and inflation-adjusted.

After the housing crisis, home values lost about a decade’s worth of appreciation, but gained much of it back when real estate boomed, thanks in part to the record low mortgage rates available.

It also helped that homes were essentially on sale, relative to the prices seen just a few years earlier.

Unfortunately, home prices have ascended to new heights we’ve never seen. And mortgage rates have more than doubled from their record lows.

So the question is do you buy a home now while mortgage rates are still low, even if prices drop later?

Or should you wait it out and let home prices pull back first, then buy, while hoping interest rates remain relatively low?

Mortgage Rates vs. Home Prices: Buy a House While Mortgage Rates Are Low? Or Vice Versa…

First things first, it’s nearly impossible to time the market. Anyone will tell you this, whether it’s a home or a stock or bitcoin or anything else.

Predicting the direction of anything can be a tall order, and real estate is no different.

Home prices are also regional, and nowadays hyperlocal, so it’s not like they’re the same throughout the country.

Not all home prices in the nation can be classified as cheap, average, or expensive – they vary tremendously, and so might their future trajectory.

At the same time, it’d be hard to argue that mortgage rates nationwide aren’t super low. So which is more important here?

It’s possible to pay more for a house while interest rates are low, but also obtain a cheaper monthly mortgage payment. And as a result, pay a lot less interest over the duration of loan term.

Let’s take a look at a scenario where mortgage rates rise and home prices slump to see which situation is more favorable to the home buyer.

Scenario 1: A Higher Purchase Price

Sales price: $400,000

Loan amount: $320,000 (20% down payment = $80,000)

Mortgage rate: 3%

Mortgage payment: $1,349.13

Total paid including interest: $165,686.80

Let’s pretend you didn’t want to wait and bought a home for $400,000 back when mortgage rates were super cheap. The price might have felt a little steep, but the 30-year fixed rate was a very attractive 3%.

You put down 20% to avoid PMI and snag a lower rate, and wind up with a monthly P&I payment of $1,349.13.

Over the course of 30 years, you pay $165,686.80 in total interest for the loan.

Now imagine home prices fall 20 percent over the next year or two, while mortgage rates rise from 3% to 6%, the latter of which already happened!

Scenario 2: A Higher Mortgage Rate

Sales price: $320,000

Loan amount: $256,000 (20% down payment = $64,000)

Mortgage rate: 6%

Mortgage payment: $1,534.85

Total paid including interest: $296,546.00

As you can see, buying the home at the higher price point with the lower mortgage rate results in both a cheaper monthly mortgage payment and significantly less interest paid over the loan term.

That could also make qualifying easier with regard to the debt-to-income ratio requirement mortgage lenders impose.

However, the down payment is $16,000 higher on the more expensive house, which could prove a barrier to homeownership if liquid assets are low.

But we’re still looking at overall savings of roughly $131,000 on the more expensive house with the lower-rate mortgage.

So should you buy a house when prices are low or when interest rates are low?

First, remember you can’t always time things. You seldomly can.

And the answer depends on personal circumstances. If down payment funds are an issue for you, the cheaper home with the higher mortgage rate might work out better.

But if you’ve got the assets and simply want to save money, the more expensive home with the lower mortgage rate could be the winner.

Hopefully this illustrates the importance of low mortgage rates. Of course, there are a ton of variables that can come into play.

Most people move or refinance their mortgages within 10 years or so from the date of purchase, making the long-term interest savings unclear.

And you can’t change what you paid for a home, whereas you can change your mortgage rate via a rate and term refinance, assuming rates improve since the original date of purchase.

Do Higher Mortgage Rates Lead to Lower Home Prices?

- Conventional wisdom says there’s a negative correlation between home prices and mortgage rates

- If one goes up, the other must fall, and vice versa

- While this seems to be logical and “make sense” is it actually true?

- Look at the many time periods where both went up at the same time

Now let’s discuss that relationship between mortgage rates and home prices, because it’s not what you might expect.

There’s a common thought that once interest rates rise, they’ll put downward pressure on home prices.

After all, prospective buyers will be able to afford less if rates are higher, thus cooling demand and forcing prices lower.

Using that logic, property values today could be artificially inflated based on the low interest rates available, which seemingly increased demand and purchasing power.

And now that mortgage rates are way up, home prices might have to come down back down to earth.

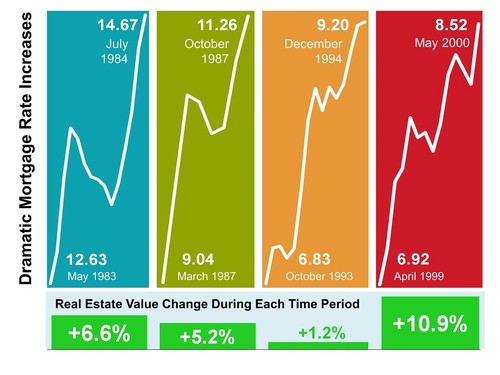

This is a bit of a myth, and the image above kind of illustrates that, though the data might also be cherry-picked to some degree.

Just consider those 1980s mortgage rates and those price increases during that troubled decade.

It Depends What’s Happening in the Economy

As you can see, house prices don’t just automatically fall when interest rates rise. If anything, the opposite has happened in the past.

Home prices and mortgage rates aren’t that closely correlated over time. In fact, mortgage interest rates may not really affect the price of housing at all.

In other words, home prices may rise even if mortgage rates increase, despite it being more expensive to get financing for said purchase.

That’s why we’ve seen home prices and mortgage rates rise in tandem thanks to rampant inflation and a continued lack of housing supply.

But due to the unprecedented increase in rates in a short period, home prices are definitely under pressure.

Just consider that rates have more than doubled in less than a year. In the 1980s they were super high and went higher, but percentage wise increased closer to 20%, not 100%!

[A 1% Decrease in Mortgage Rates Is Worth an 11% Drop in Home Prices]

How Do Interest Rates Affect Real Estate Prices?

- Both may rise or fall in tandem over time (or diverge) depending on myriad factors

- Don’t expect a deal on a house just because mortgage rates are higher

- Or for interest rates to suddenly drop if home prices have increased

- The health of the economy can drive both higher or lower simultaneously

Believe it or not, both home prices and interest rates may rise together.

This is partially because not everyone buys real estate with a mortgage, instead using cash, and also due to macroeconomic factors.

If the economy gets hot, like it has been lately, interest rates will likely rise to stem inflation concerns.

The issue over the past years has been the Fed cleaning up its mess, ironically driven by low mortgage rates.

They’ve been raising their own rate (fed funds rate) and put an end to their bond purchase program after receiving signs that inflation was moving much higher than expected.

Ultimately, home prices will moderate because of the unprecedented rise in interest rates. But this is a unique situation. As noted, rates are up 100%+ on a percentage basis.

However, the economy has yet to slow signs of a significant slowdown, which keeps the pool of prospective home buyers steady.

Higher Rates Lower Housing Demand, But…

During normal times, higher interest rates decrease housing demand. This means fewer sales, and also lower prices. Less demand should mean more supply, and thus lower prices.

However, these aren’t normal times. Consider the the mortgage rate lock in effect. Most existing homeowners have mortgage rates in the 2-4% range.

With rates now approaching 7%, the desire (and even the ability) to sell should go down tremendously.

And this should theoretically worsen as rates rise. A 30-year fixed at 8% makes this desire/ability even weaker.

Remember, housing supply was low to begin with, and if existing owners aren’t selling, it further restricts supply.

The only real caveat maybe a cash buyer downsizing, or an unemployed homeowner being forced to sell.

So it’s perfectly feasible to arrive at a scenario where mortgage rates are higher and home prices continue to rise, or simply pull back slightly, as opposed to crash.

A strong economy with more jobs and higher wages leads to a greater number of eligible home buyers.

All of that can lead to more demand and even higher home prices. So don’t just assume home prices will drop if mortgage rates rise.

Read more: What mortgage rate can I expect?

[ad_2]