[ad_1]

Get Pre-Approved for a Mortgage and Check Rates

Mississippi Home Corporation’s Smart Solution Program

The Smart Solution program is for first-time homebuyers and repeat buyers that offers financial assistance for the down payment on a new home purchase in the state of Mississippi. Applicants must have at least a 640 credit score and a household income not exceeding $95,000. More info

Eligibility

- Must serve as your primary residence

- Household annual income cannot exceed $95,000

- Must be a legal resident of the United States

- Must have a minimum credit score of 640 for FHA, USDA, or VA loans and Freddie Mac loans

Property Eligibility

- New or existing home located in the state of Mississippi

- Single-family home, townhouse, condominium, or duplex

- Manufactured homes using FHA financing

Benefits to Homebuyers

- 97% Loan (Freddie Mac Only)

- Lower mortgage insurance premiums

- Competitive interest rates quoted daily

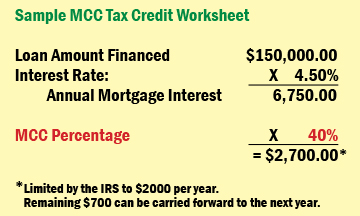

- First-time homebuyers may be eligible for more savings by combining a Mortgage Credit Certificate (MCC) with MHC’s Smart Solution Mortgage. Qualifying homebuyers may claim 40% of their mortgage interest (up to $2000 per year) as a credit on federal income taxes, while still claiming the remaining 60% of interest as a deduction

- Smart Solution and the MCC are both available statewide through participating lenders. Contact a participating lender below to find out if you qualify for MHC’s Smart Solution mortgage program

MHC Mortgage Revenue Bond 7

The Mississippi Home Corporation is able to assist borrowers with homeownership by offering a competitive mortgage rate through proceeds from the sale of Mortgage Revenue Bonds. $7,000 to assist borrowers with upfront costs associated with their mortgage purchase. More info

Features of the MRB7 Program

- 30 year fixed rate first mortgage (rate subject to change)

- FHA insured, VA, Rural Development, and Fannie Mae/Freddie Mac Loans

- No liquid asset limit

- $7,000 deferred 10-year second with 0% interest (forgivable after 10 years)

Who is eligible

- First-time homebuyers or persons who have not owned a principal interest in a residence in the past 3 years

- Certain areas of the state, called “Target Areas” and Veterans are exempt from the “first-time homebuyer” rule

- Applicants who meet the credit requirements established by FHA, VA, Rural Development, Freddie Mac, and FannieMae products

- Households who are within the income guidelines for the county in which they purchase a home

Program Requirements

- Property must be owner-occupied

- Property must be the principal residence

- Single family detached or attached

- Fee simple townhomes

- Condominiums that are FHA, VA, or Conventional Approved • Permanently affixed manufactured homes that meet FHA, VA, RD, or FannieMae requirements

- The cost of the home must be within the maximum permissible acquisition cost based on Target or Non-Target county designation where the property is located

- Home purchase limit for target area: $289,705

- Home purchase limit for non-target area: $237,031

Mortgage Credit Certificate (MCC)

The Mortgage Credit Certificate (MCC) reduces the amount of federal income tax the borrower must pay, which frees up income to qualify for a mortgage. Homebuyers must not exceed household income and home purchase price limits set according to federal tax law and MHC guidelines. More info

Features

- Lender follows guidelines depending upon which type of loan is utilized

- MCC can be used with Fannie Mae conventional, fixed-rate, adjustable-rate, FHA, VA, and RD financing. MCC may also be combined with MHC’s DPA, Home Loan Plus, and Smart Solution programs

Who is eligible

- First-time homebuyers or persons who have not owned a principal interest in a residence in the past 3 years

- Certain areas of the state, called “Target Areas”, are exempt from the “first-time homebuyer” rule

- The maximum annual income of household members may not exceed certain income limits

Program Requirements

- Property must be owner-occupied

- Property must be the primary residence

- Must be a single-family residence

- Manufactured home must be HUD-approved

- The borrower must own or purchase land on which the manufactured home will be sited

- The cost of the home must be within maximum acquisition cost limits for the county in which the property is located

- The borrower must have available the following:

- $300 non-refundable reservation fee to participate in the program

- Sales contract including a legal description of the property

- Federal income tax returns for the past three years, and any other documents required by the lender

- Homebuyer education certificate showing completion of classroom or online course

Housing Assistance for Teachers

The Housing Assistance for Teachers Program (HAT) was designed to assist with funding to help teachers buy homes. Making homeownership easier will certainly encourage teachers to move to these shortage areas. More info

Who is eligible

- Applicants who agree to render service as a teacher in the district for three years starting with the beginning of the school year

- Applicants meeting the credit eligibility requirements of FHA, VA, RD Guaranteed, Fannie Mae or Freddie Mac

Program Requirements

- 25 or 30-year fixed loan rate

- FHA, VA, RD Guaranteed, Fannie Mae, or Freddie Mac

- Credit score dependent upon LTV

- Mortgage Insurance is required (depending on LTV)

Features of the HAT Program

- Grant assistance is forgiven if the approved licensed teacher satisfies a required executed Loan Agreement.

- MS Dept. of Education covers the amount of borrower funds needed to close on a home up to and not to exceed $6,000.

- MS Dept. of Education assistance can be used to cover the required down payment (less borrower’s 1% required contribution)

- Homebuyer(s) must provide a minimum down payment from one’s own funds of 1% of the sales price and one month’s reserves.

- No income limits unless used with another MHC loan product (see other program guidelines).

- Residential property must be located within the county where the teacher is employed and is designated by the MS Department of Education as a critical shortage school district.

National First-Time Homebuyer Loans

- FHA Loans – FHA home loans are very popular with first-time homebuyers cause they require a 580 credit score with just a 3.5% down payment. Debt-to-income ratios up to 50% are allowed making them perfect for low-income borrowers.

- Conventional Loans – Conventional loans require a 620 credit score and a 5% to 20% down payment. If you put 20% or more down, mortgage insurance will not be required.

- USDA Loans – USDA mortgage loans are for low-to-median income borrowers buying a home located in a USDA-eligible rural area. They provide 100% financing with a 620 or higher credit score. Mortgage insurance is required but the rate is the lowest of any type of mortgage program available.

- VA Loans – Veterans of the U.S. military may be eligible for a VA home loan. No down payment or mortgage insurance is required and veterans with a 580 to 620 credit score are eligible.

- HomeReady and Home Possible Loans – Freddie Mac and Fannie Mae created the HomeReady and Home Possible loan programs for low-income first-time homebuyers whose income does not exceed 100% of the area median income requiring just a 3% down payment and a 620 credit score.

Helpful Resources

Statewide Programs

Getting Started

- Housing counseling agencies – free or low-cost counseling services for buying, renting, defaults, foreclosures, credit issues and reverse mortgages

- Predatory lending – beware – whether you’re buying or refinancing your home, don’t become a victim of unfair lending practices

Buying a Home

Owning and Maintaining Your Home

Other Mississippi Resources

[ad_2]